2020 will be the biggest year in the history of the hydrogen and fuel cell industry. You would have never predicted this, had you only been tracking the opinions of Elon Musk.

Elon Musk mistakenly refers to them as “fool cells”, but there’s no fooling about this: fuel cells are set for a breakout in 2020.

Why?

Three reasons: performance, cost reduction, and sustainability. Today, I’ll deep-dive into all three areas, to show why fuel cells are poised to make a big impact on the motive industry this year.

3 Reasons Fuel Cells Are the Zero-Emission Technology for 2020 and Beyond

Performance: The Only Viable Solution for Electrification of Heavy-Duty Motive

Although it’s taken some time, there’s a growing industry consensus that fuel cells offer the only viable solution to electrify certain medium-duty and heavy-duty vehicles.

The real challenge to electrifying heavy-duty motive comes down to this:

How can you offer fleet operators the benefits of legacy diesel, including heavy payload, long range, fast refueling, route flexibility, and a similar operating experience, while also offering the benefits of electrification, including zero tailpipe emissions, low noise, low vibration, and fast and smooth acceleration?

Fuel cell electric vehicles (FCEVs) uniquely provide the answer. FCEVs meet all of the above requirements, effectively addressing the limitations of stand-alone battery electric solutions that are range-constrained, require long recharge times or on-route recharging infrastructure, are limited to certain routes, and compromise payload.

Medium and heavy-duty vehicles also present the lowest barriers to entry on hydrogen refueling. That’s because these vehicles typically return back to base at night and can be quickly refueled at a centralized hydrogen refueling station at the depot. Again, this is consistent with current user experience with diesel.

We also see opportunities for hydrogen refueling corridors with high utilization to enable coaches, long-haul trucking, and other use cases. Notably the cost for delivered hydrogen ($/per kg) is significantly compressed with scaled infrastructure with high utilization.

Clockwise from top: UPS Hydrogen Fuel Cell Truck, Orange County Transit Association Hydrogen Fuel Cell Electric Bus, Kenworth Hydrogen Fuel Cell Truck

Clockwise from top: UPS Hydrogen Fuel Cell Truck, Orange County Transit Association Hydrogen Fuel Cell Electric Bus, Kenworth Hydrogen Fuel Cell Truck

From an emissions perspective, heavy-duty vehicles including commercial trucks and buses, provide a disproportionate amount of greenhouse gases and other emissions. Hydrogen and fuel cells enable us to address these hard-to-abate emissions.

We believe that the performance value for FCEVs in heavy-duty motive will be further validated in 2020, including increased adoption in buses, commercial trucks, trains and marine.

Cost Reduction: FCEVs Will Be the Most Affordable Option Within the Next Decade

In less than 10 years, it will become cheaper to run an FCEV than a battery electric vehicle (BEV) or an internal combustion engine (ICE) vehicle for certain commercial applications.

Although FCEVs are currently more expensive to run per 100 kilometers than BEVs and ICE commercial vehicles, they’re set to become much cheaper as manufacturing technology matures, economies of scale improve, hydrogen fuel costs decline, and infrastructure develops.

This is the conclusion of a recent report entitled Fueling the Future of Mobility: Hydrogen and Fuel Cell Solutions for Transportation jointly published by Deloitte China and Ballard.

The report undertakes a comprehensive TCO analysis, applying a detailed and objective model to various heavy-duty motive transportation scenarios across different geographic settings: logistics trucks in Shanghai, drayage trucks in California, and transit buses in London.

Refire fuel cell truck fleet

Refire fuel cell truck fleet

The report projects that:

- the TCO for commercial hydrogen vehicles will fall by more than 50% within the next 10 years.

- FCEVs will be less expensive than BEVs and ICE vehicles in all of the above scenarios by 2027, without subsidies.

Additionally, in 2020, we’re expecting significant developments in the hydrogen and fuel cell industry in terms of cost reduction, including lower costs on:

- fuel cell stacks, including membrane electrode assemblies and plates

- fuel cell module balance of plant components

- system and powertrain components, including DC-DC converters, controllers, storage tanks, batteries, and integration

- green hydrogen production, including renewable energy for the production of hydrogen and multi-megawatt electrolyzers

- delivered hydrogen, including transportation and refueling station equipment

- maintenance and service for FCEVs

We’ll see overall costs coming down with many levers being pulled in 2020, including continued innovation, lower cost materials, increased supply chain options, volume and lower cost production. I’m expecting significant cost reduction in 2020, followed up with much deeper decreases in subsequent years.

Look for an upcoming industry report that studies the roadmap for cost reduction of hydrogen and fuel cells.

Sustainability: FCEVs Address Emissions Throughout the Product Life Cycle

Government, fleet users, logistics companies, and consumers are all moving aggressively toward zero-emission mobility. There’s an accelerating shift toward cleaner and cost effective solutions in the medium and heavy-duty motive markets.

It’s certain that the market will shift away from pure diesel vehicles, and toward alternative powertrain systems.

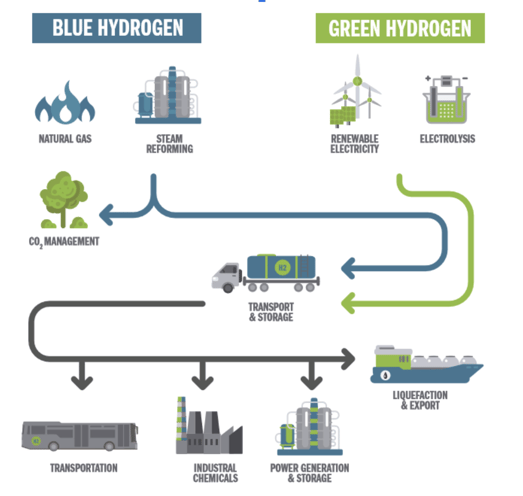

In 2020, we expect to see further validation that FCEVs powered by green hydrogen offer the most sustainable solution to decarbonize mobility. The graphic below shows how green hydrogen is produced, transported, and stored.

Learn more about different types of hydrogen production in How We Can Transition to a Low Carbon Future [Interview].

Hydrogen also uniquely offers the opportunity to form links between sectors such as transport, electricity, and industry to decarbonize the wider economy.

The Deloitte China-Ballard white paper I referred to previously provides a review of energy efficiency, hydrogen production, green gas, and other environmental impacts related to fuel cell technology today and going forward.

The paper concludes that FCEVs are more attractive environmentally than BEVs and ICE vehicles from a number of perspectives, including production, operation, and end-of-life.

What Other Industry Advancements Will Happen in 2020? My Additional Predictions

Beyond the predictions I’ve already made, here are some additional developments to watch for this year in the hydrogen and fuel cell industry:

- another year with a strong record of safety.

- continued or increased commitment for hydrogen and fuel cells from Germany, France, the UK, the Netherlands, Norway, Denmark, Japan, China, South Korea, Australia, the US and Canada.

- increased corporate investment, with increased spend by vehicle OEMs, powertrain players, Tier 1 suppliers, and the entrance of tech giants into the space.

- continued mergers and acquisitions in the hydrogen and fuel cell industry.

- the 2020 Tokyo Olympics will profile the vision of hydrogen and fuel cells, capturing the imagination of Generation Z.

- a huge year in the China fuel cell industry, with policy clarifications, increased deployments and hydrogen infrastructure build-out.

- at least one major European mobility player will announce the future of fuel cell solutions for heavy-duty motive applications.

- Toyota and Hyundai to continue to dominate deployments of fuel cell passenger cars, and

- Elon Musk will not admit he’s wrong.

FCEVs for commercial vehicles will offer the most attractive overall solution when you consider:

- vehicle performance

- total cost of ownership (lifecycle costs)

- scaling of electric recharging vs. hydrogen refueling infrastructure

- wells-to-wheels (cradle to grave) carbon intensity

- supply chain risks

- labour disruption/transition