Mobility is undergoing a profound transformation.

It’s now broadly recognized that the energy transformation required to limit global warming to 2 degrees Celsius (as agreed in the COP21 Paris climate accord) must include the complete decarbonization of mobility.

Achieving this requires a massive shift away from vehicles with internal combustion engines powered by gasoline and diesel, to zero emission electric vehicles.

Electrification of Mobility Is Complex and Needs Diverse Solutions

There are two primary forms of vehicle electrification: battery electric and fuel cell electric. Both forms are needed to achieve the desired energy transformation for mobility. They are complementary: they use the same electric powertrain, best serve different use cases, and can be paired in hybrid architectures.

Notwithstanding the complementary technical advantages and market use cases for battery electric and fuel cell electric powertrains, there is an ongoing debate about the relative merits of these two powertrain technologies.

And despite heightened political and social pressures on the decarbonization of mobility, the debate has been surprisingly superficial, particularly given the complexity and significance of the issues.

Batteries vs. Fuel Cells: A Comparative Assessment Model

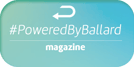

In my opinion, a full comparative assessment of batteries vs. fuel cells in the electrification of mobility must consider the following issues:

In my opinion, a full comparative assessment of batteries vs. fuel cells in the electrification of mobility must consider the following issues:

- vehicle performance

- total cost of ownership (lifecycle costs)

- scaling of electric recharging vs. hydrogen refueling infrastructure

- well-to-wheels (cradle to grave) carbon intensity

- supply chain risks

- labor disruption/transition

The “Submerged Debate”: Too Many Issues Are Not Being Discussed

In recent industry discussions, I’ve been referring to the debate surrounding these issues as the “submerged debate”. Think of an iceberg. A few of the issues – such as vehicle performance and costs – are being openly discussed “above the surface” (albeit with limited data.)

Meanwhile, many additional important issues remain submerged “below the surface”, without a meaningful and open public discussion. To pretend otherwise is a perilous course.

To avoid a disastrous Titanic-like outcome, companies, organizations, and governments must make informed and risk-adjusted decisions with a sound understanding of the terrain, including the potentially potent force of these “submerged” issues.

It’s beyond the scope of this blog to address all of the submerged issues. So, I want to discuss a specific supply chain risk facing the battery industry that is lurking just below the surface.

Battery Precious Metals Have Serious Supply Chain Risks

The production of current leading batteries for electric vehicles uses certain rare earth metals, which I often refer to as “battery precious metals”. These include lithium, nickel, manganese, and cobalt. There are concerns regarding the future of the raw material supply of these metals.

We must consider potential future constraints on battery production given supply chain risks. We must also consider the strong nexus between limited availability of battery precious materials and resultant pricing increases and volatility on battery production costs.

There are also other consequential issues related to macro global political and economic power, shifting industry profit pools, ethical sourcing, and carbon intensity.

All players across the industry value chain—including automotive OEMs, powertrain suppliers, battery manufacturers, mining companies, financial investors, and governments—must fully understand the complexities of this rapidly-changing market.

This is a challenging task, even for sophisticated, well-researched and well-capitalized organizations. Indeed, a credible risk assessment must be grounded in a sound understanding of:

- future supply and demand dynamics of battery precious metals

- supply chain ownership considerations

- sourcing strategies

- pricing volatility

- future battery technology (chemistry) evolution

- ethical sourcing considerations

- carbon intensity

- risk management

Industry participants must ensure their long-term strategies are resilient in the face of many dynamic uncertainties.

While there is much to unpack here, I’d like to dive specifically into the topic of the serious supply chain risks related to cobalt.

What Is Cobalt?

Cobalt is a bluish-grey metal that serves as a key ingredient in most lithium-ion and NMC batteries. Cobalt enhances battery safety and stability. This is particularly important for batteries that need to handle deep charging and discharging cycles.

Cobalt is a bluish-grey metal that serves as a key ingredient in most lithium-ion and NMC batteries. Cobalt enhances battery safety and stability. This is particularly important for batteries that need to handle deep charging and discharging cycles.

Cobalt Demand Is Growing Exponentially

More than half of all cobalt mined and produced now goes into lithium-ion batteries. Portable electronics and laptops have set a rising demand floor. And there are now growing needs for energy storage, e-bikes, and electrification of tools.

With the switch to electric vehicles, the demand spike on top of this rising floor is set to expand dramatically. Cobalt demand is forecasted to increase from 136 kilotons (kt) in 2017 to 272 kt in 2025. Cobalt for use in batteries is expected to increase by a factor of 4 in 2030 in comparison to today’s levels.

Cobalt Supply Concerns Need to Be Addressed

Less than 10% of cobalt supply occurs as a primary product. Approximately 90% of all cobalt supply comes as a low concentration byproduct of copper or nickel production. There are only two operating cobalt mines where cobalt is the main product.

Growing global demand and inelastic supply means that international prices are likely to soar and experience periods of high volatility. We have already seen instances over the past few years where prices have quadrupled on the back of rising demand from automakers and inelasticity of supply.

Importantly, today more than 65% of the world’s mined cobalt supply comes from just one country – the Democratic Republic of the Congo (DRC). That share is expected to increase even further to 75%. Most of the cobalt in the Congo comes from Kinshasa.

The DRC has significant country risk. It is one of the world’s least developed countries. It has a dismal record of political instability, armed conflict, widespread corruption, and child labor. Although cobalt is a core pillar of the DRC economy, there is very little transparency in the cobalt supply value chain.

With the surge in cobalt demand from the growth in battery electric vehicles, there has been growth of industrial mines in Kinshasa. There has also been a massive rush of “artisanal” cobalt being produced in the Congo. It’s estimated that 15-30% of the DRC’s cobalt supply is extracted by hand using basic tools in these artisanal, and in many instances illegal, small-scale mines.

Severe social risks have been well documented in the DRC’s artisanal mining industry. They include:

- hazardous working conditions

- deaths due to poorly secured underground mining practices

- various forms of forced labor

- child labor

- exposure to fine dusts and toxic particulates

The China Factor

In addition to DRC country risk, there are also concerns about China’s growing control and influence over the cobalt supply chain. Although the DRC is the leading supply of mined cobalt, it is the PRC – the People’s Republic of China – that is the world’s leading producer of refined cobalt.

In 2016, China’s production of refined cobalt was 34 times that of 2000 levels. In 2018, approximately 60% of the world’s refined cobalt supply came from China.

Most of China’s production is based on raw or partially refined cobalt imported from the Congo (Kinshasa). China has been a prominent player in the competition to secure raw cobalt materials. The Chinese government officially initiated the Going Out Strategy around the year 2000.

This policy encouraged Chinese companies to expand overseas foreign direct investment, especially for mineral resources and infrastructure in developing countries in Africa and Asia. The “minerals for infrastructure deal” between China and the DRC is representative of this policy.

In this deal, Chinese state-owned banks provided favorable loans to the DRC government for infrastructure, purportedly in exchange for access to copper and cobalt mineral development rights. Chinese companies have gained significant ownership interests and influence over Congo cobalt mining.

In May 2018, the United States Department of the Interior published a list of 35 critical materials, including cobalt. This list was developed to serve as an initial focus on a US federal strategy to ensure secure and reliable supplies of critical materials.

Cobalt Thrifting: Is it the Solution?

Cathode composition is the main differentiating factor between lithium-ion batteries. The cathode accounts for approximately 25% of a battery pack’s costs, so the choice of raw materials in the cathode is important.

With the so-called “cobalt cliff” looming, the battery industry has been considering cobalt thrifting. This is essentially looking for ways to reduce cobalt content in battery cells—specifically in lithium-ion batteries.

Most players are aiming to move from today’s approximately 20% cobalt content nearer to 10% by using 8-1-1 chemistries (8 parts nickel, 1 part cobalt and 1 part manganese). However, there are legitimate safety and stability concerns associated with chemistries that propose a higher concentration of nickel and a lower concentration of cobalt.

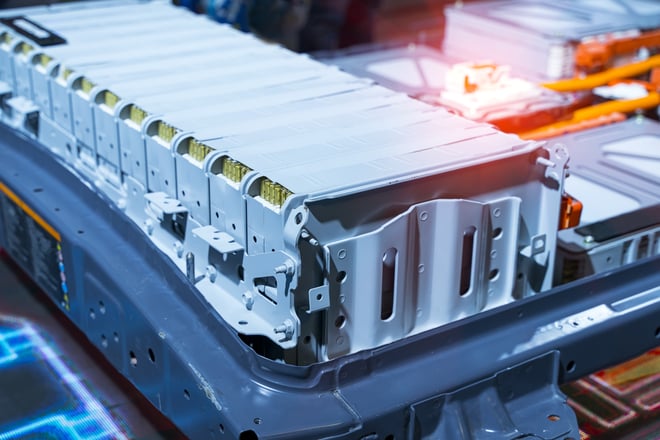

Zero-Emission Fuel Cells: The Alternative With No Cobalt

Fuel cell electric powertrains offer a compelling alternative to the use of stand-alone pure battery electric propulsion systems.

The use of hydrogen fuel cell technology, including pairing fuel cells with smaller batteries in hybrid architectures, will enable a significant reduction in cobalt demand. This will reduce and mitigate the challenges and risks associated with the cobalt supply chain.

Industry and government are increasingly adopting the view that fuel cell electric vehicles offer superior performance and value in mobility applications and use cases that are energy intensive and:

- require long range

- fast refuelling

- heavy payload

- route flexibility

The early adoption use cases for fuel cell electric vehicles (such as city buses, delivery trucks, and trains) will include fleets that return to depots for centralized hydrogen refueling, as they typically do for diesel refueling.

(Learn more in Four Clear Signs That Fuel Cells Will Power Commercial Vehicles.)

So What Does All of This Mean? Many Questions Persist

There are troubling issues and questions surrounding the growing use of cobalt in lithium-ion batteries for the electrification of mobility. Are countries—for example, France, Germany, UK and US—and industry players, including automotive OEMs such as Daimler, Toyota and VW comfortable being beholden to Congolese virtual singular supply of raw cobalt?

Are they comfortable with the DRC’s political instability and corruption? How will they ensure supply chain transparency and ethical sourcing, including eliminating human rights violations, child labor and unsafe mining conditions, particularly in artisanal mining?

How will they ensure responsible supply chains from conflict-affected and high-risk areas? Are these countries and companies concerned about Chinese ownership interests in Congolese mines and the global concentration of cobalt refining in China?

What are their views on the supply and demand dynamics, including potential battery production capacity constraints and pricing volatility? How would future pricing increases impact economics and financial performance?

What about the well-to-wheels carbon intensity of producing batteries, including the mining and refining of battery precious metals? Are these risks appropriately factored into long-term strategies, cost reduction roadmaps and sustainability?

Final Thoughts

The decarbonization of transportation is a necessity if we’re to meet our Paris Accord commitments. While battery electric vehicles have a place within an overall decarbonization strategy, the lithium-ion batteries that power them have concerning supply chain issues.

It will be up to governments and automotive OEMs to answer the tough questions associated with this technology, and to understand the benefits of other technologies like hydrogen fuel cells.

Now it’s over to you. What do you think? Let us know what you think about the supply chain issues associated with lithium-ion batteries in the comments below.