In the race towards a greener future, the North American transport sector is undergoing a significant transformation. Leading this charge is the remarkable growth of zero-emission buses (ZEB) – both battery electric and fuel cell electric – which are quickly becoming the backbone of public transit across the continent.

While there is consensus that no “cookie cutter” solution currently exists – duty cycles, climate, terrain, and depot location are all factors determining the right technology for the operator’s needs – transit agencies are increasingly choosing hydrogen buses for their fleets. Their motivation – longer operational range, quick refueling, and robust performance in a variety of climates, are all critical factors for the diverse geographical and weather conditions across the continent.

Unlike electric buses, which may require several hours to recharge, hydrogen buses can be refueled in as little as 10 minutes, mirroring the convenience of traditional diesel buses but without the environmental toll. Furthermore, the scalability of hydrogen fueling infrastructures and the potential for green hydrogen production to align with global climate goals, makes hydrogen buses not just a transitional technology but a long-term sustainable solution to public transit.

In this blog, three U.S. transit operators provide insights on the facts and figures driving their decisions – and why transit agencies are increasingly betting on hydrogen technology over electric alternatives.

Participating transit agencies

Foothill Transit Agency, serving eastern Los Angeles County, operates a diverse fleet of 359 buses over 327 square miles, with an annual ridership of nearly seven million passengers. Their fleet consists of 307 compressed natural gas (CNG) buses, 33 fuel cell electric buses, and 19 battery electric buses.

In this interview, Roland Cordero, Director of Maintenance and Vehicle Technology, shares insights into the agency's shift towards ZEBs, including the operational challenges and benefits associated with hydrogen fuel cell buses over battery electric vehicles.

In this interview, Roland Cordero, Director of Maintenance and Vehicle Technology, shares insights into the agency's shift towards ZEBs, including the operational challenges and benefits associated with hydrogen fuel cell buses over battery electric vehicles.

Due to the operational limitations of electric buses – 150 miles on a charge versus the expected 252 miles in Foothill’s experience – transitioning to a full electric fleet would cost over $120 million. This is exacerbated by insufficient space for the necessary infrastructure and larger fleet size, based on a 1.5:1 replacement ratio for diesel buses. In contrast, Foothill finds that fuel cell buses offer a seamless transition from CNG buses, with similar refueling times and operational practices, and offers the same consistent performance regardless of external conditions.

Southeastern Pennsylvania Transportation Authority (SEPTA) is a public transportation authority on the east coast of the U.S. that provides transit services to nearly four million people in and around Philadelphia, Pennsylvania. The agency operates a wide range of transportation options, including bus, rapid transit, commuter rail, light rail, and electric trolleybus services. It is the sixth largest transit agency in the country, with a daily bus network ridership of approximately 300,000 people.

Here, Tyler Ladd, Director of Power Engineering at SEPTA, provides key insights into their evaluation of zero-emission technologies, particularly focusing on service impact of electric and fuel cell buses.

Here, Tyler Ladd, Director of Power Engineering at SEPTA, provides key insights into their evaluation of zero-emission technologies, particularly focusing on service impact of electric and fuel cell buses.

SEPTA’s evaluations revealed significant infrastructure challenges and costs associated with accommodating battery electric buses, including the need for extensive electrical upgrades and space for charging equipment. In contrast, fuel cell buses require minimal electrical upgrades and less space, offering a more cost-effective and feasible solution.

The Champaign-Urbana Mass Transit District (MTD) is a transit system in eastern Illinois. MTD is based in Urbana and operates from the Illinois Terminal in downtown Champaign. In the second quarter of 2023, the system had 7,797,100 riders, with an average of 21,900 riders per weekday. They have 118 buses, with a fleet made up of 98% hybrid and 2% hydrogen electric vehicles.

Karl Gnadt, the Managing Director of MTD, discusses the company's transition to hydrogen-powered buses and outlines the key advantages and insights gained from the agency's initiative to provide true zero-emission operations to the Champaign-Urbana community.

Karl Gnadt, the Managing Director of MTD, discusses the company's transition to hydrogen-powered buses and outlines the key advantages and insights gained from the agency's initiative to provide true zero-emission operations to the Champaign-Urbana community.

Karl emphasizes the importance of long-term planning and considering the scalability of infrastructure when choosing between electric and fuel cell buses. He notes that while electric buses may appear cost-effective for small-scale implementations, fuel cell buses become more economical as the fleet size increases due to scalable refueling infrastructure.

What was learned?

The key priority for all three transit agencies is to provide a high-quality rider experience, including vehicle comfort and minimum wait times though high vehicle availability and no compromise on range and performance.

Operational Range:

Most frequently quoted as the key criteria, range and refueling time determines vehicle availability and ultimately the number of vehicles an operator needs to deliver the required service.

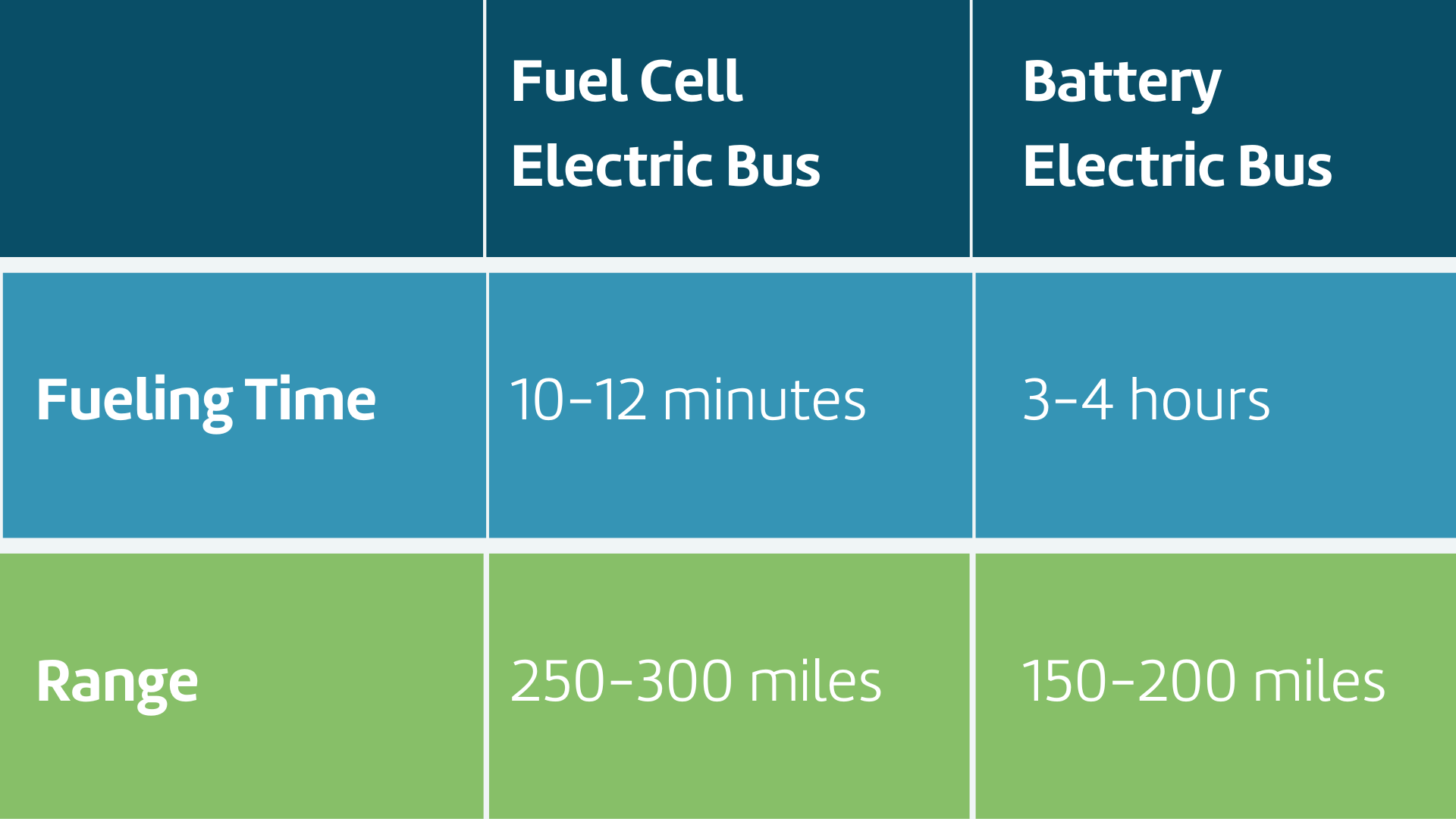

SEPTA's data illustrates the distinctions in refueling/recharging times and operational ranges:

Fuel cell buses offer range and refueling time comparable to diesel and CNG buses, making them a true 1:1 replacement in a fleet, without the need for route adjustments. In contrast, electric buses may necessitate multiple units to cover the same routes due to shorter range and longer charging times. Strategies to mitigate the limitations for electric buses include adjusting schedules, increasing layover times, and installing en-route charging stations - all of which involves significant investment.

Cold weather performance:

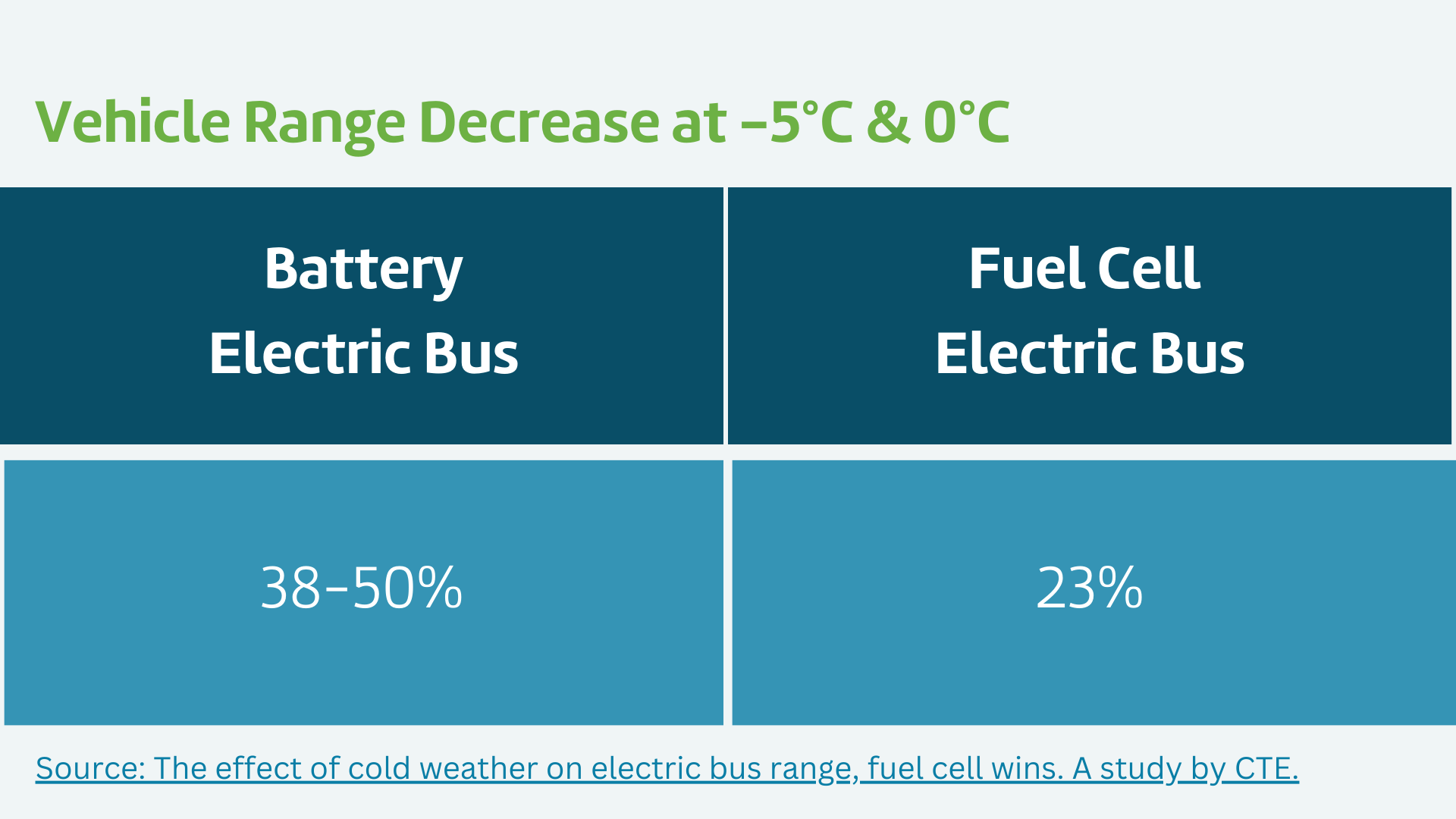

The operational range of electric buses is influenced by external temperatures and the use of climate control systems. At temperatures between -5°C and 0°C, an electric bus’s range can decrease by 38-50%, as heating needs depletes battery energy.

Conversely, fuel cell buses experience a lesser range reduction of about 23% under similar conditions, benefiting from the heat generated by the fuel cell for passenger heating, without compromising propulsion energy.

Electric charging vs. hydrogen fueling infrastructure:

Depending on the transit agency’s operational needs, electric charging infrastructure encompasses plug-in, overhead conductive (pantograph), and wireless inductive methods. The infrastructure also includes power supply and management software for load balancing and monitoring. En-route charging is necessary for electric buses to cover typical urban transit distances, with infrastructure investments reaching up to $700,000 per charging station, as reported by Foothill Transit. Electric grid capacity may also not be available - or it could take years for the electric infrastructure to be built or upgraded to meet a bus depot's electric charging demands.

Fuel cell buses are supported by hydrogen fueling stations, which can produce green hydrogen on-site or receive deliveries. Despite the initial setup appearing costly, the scalability of hydrogen infrastructure offers long-term benefits, with minimal additional investments required for expanding fleets. Foothill Transit's Pomona yard, for example, demonstrates an efficient hydrogen fueling setup capable of serving 33 fuel cell buses without significant delays or operational downtime.

Capital investment:

The initial capital investment for electric buses tends to be lower for small fleets if existing electrical services are adequate. However, the scalability of hydrogen infrastructure means that, despite higher initial costs for fuel cell buses, the per-unit cost decreases significantly as the fleet size increases. Operational costs for both bus types have been similar, but fuel cell buses often have lower mid-life maintenance costs.

Progress through policy

Building on intensified financial support of the public transit sector in 2024, the U.S. Department of Transportation’s Federal Transit Administration (FTA) is again providing $1.5bn of funding – assisting state and local governments in their efforts to establish and improve low- and zero-emission transit bus fleets and facilities across the country.

$390m of the available funding is apportioned to the FTA’s Low or No Emission Program (Low-No). This initiative aims to drive the decarbonization of transit bus fleets by modernizing buses, improving bus facilities, and supporting workforce training and development.

Applicants are required to submit their bid proposals to the FTA and funding is allocated on a competitive basis. The deadline to submit for support in 2024 is April 25.